The Best Invoice Factoring Software

You deserve a factoring system that grows with your business! Save time, spend less, and factor more invoices.

Grow revenue, reduce risk, and improve customer trust.

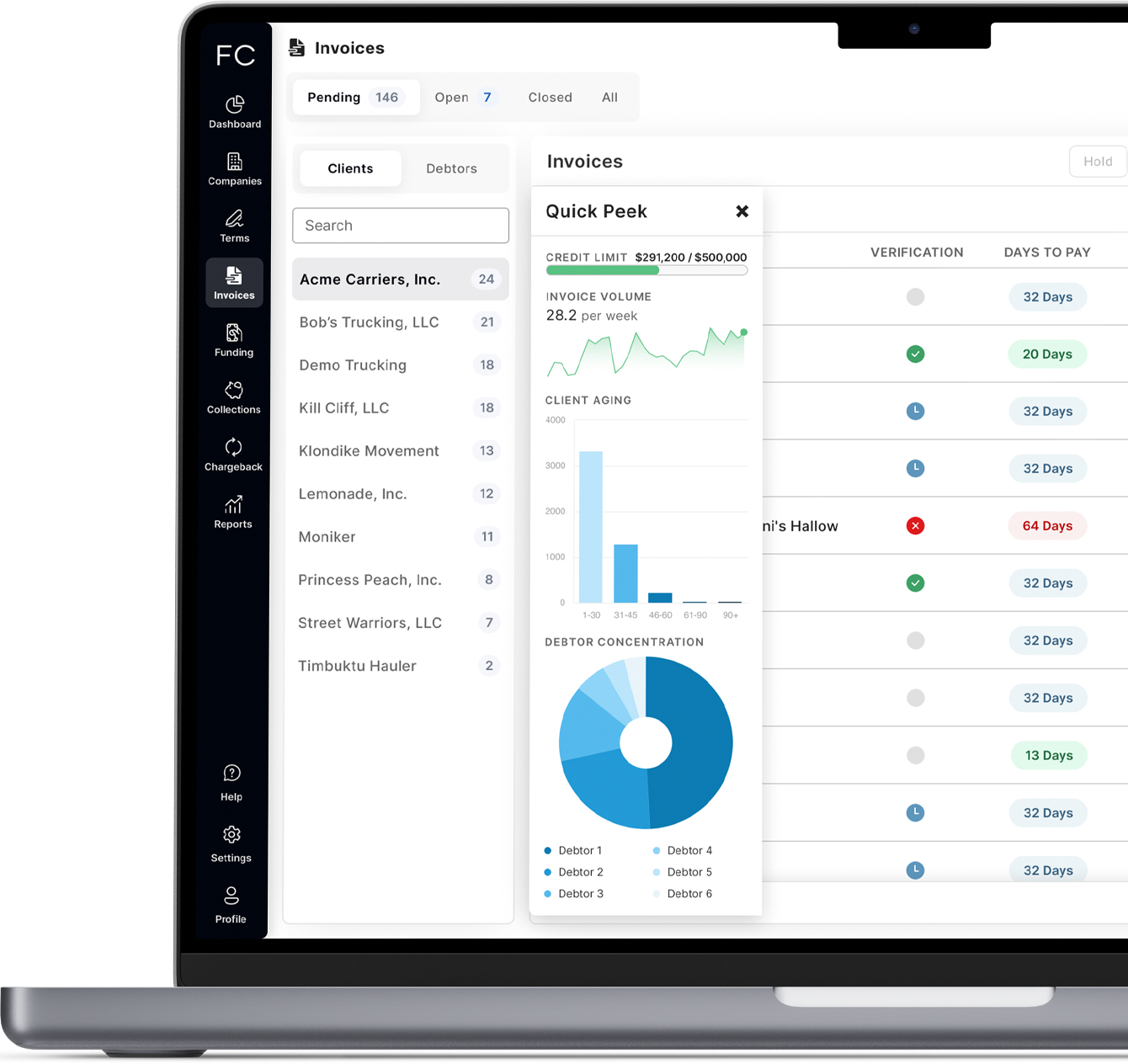

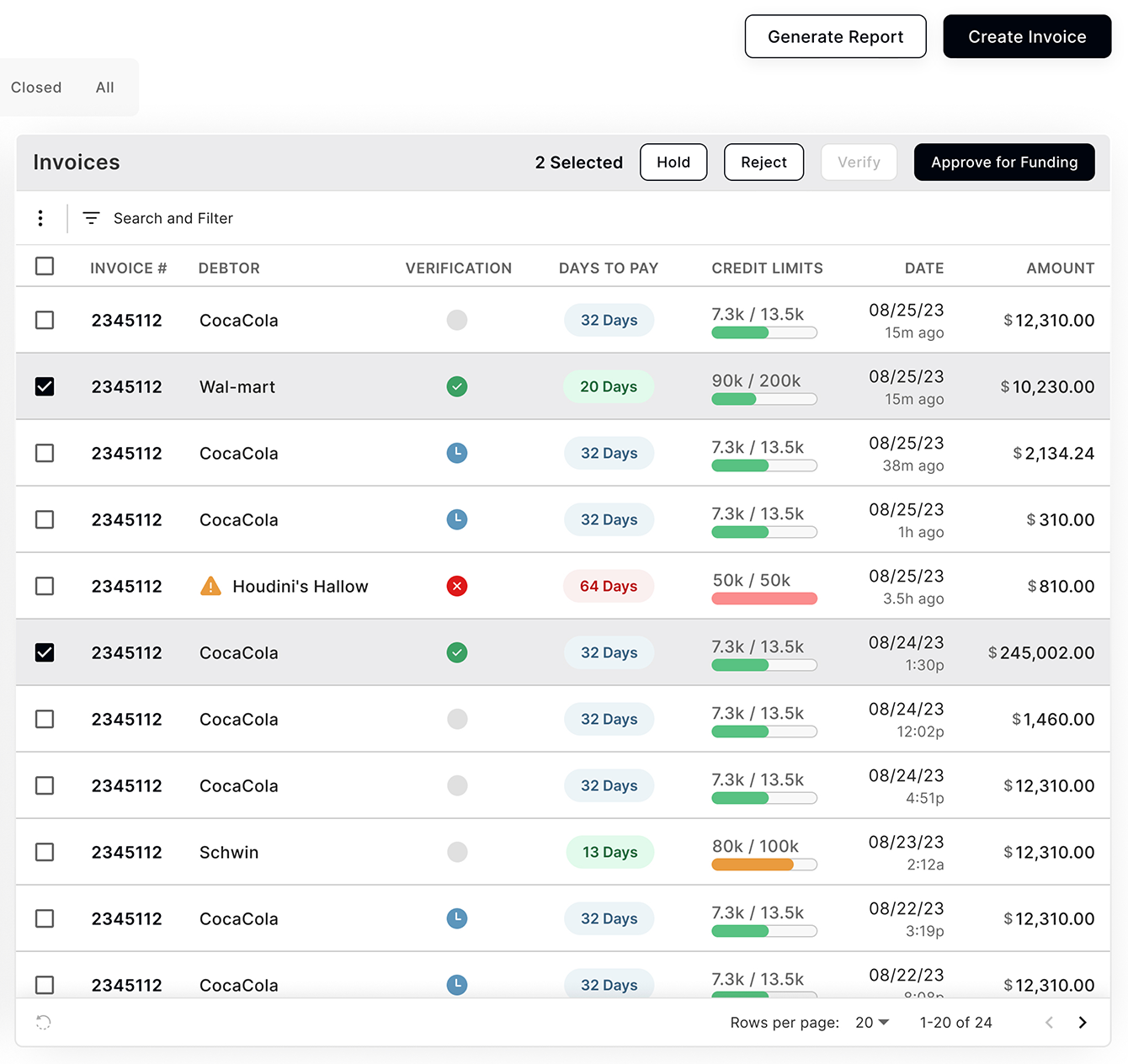

FactorCloud is the modern cloud-based factoring solution built by factors, for factors.

Our open API allows you to integrate with industry-leading providers in no time.

Automated workflows free up time and allow you to focus on the things that matter.

Our modern interface and powerful software make it easy to grow and manage a bigger book of business.

One software to help your team

increase revenue, reduce costs, and save time.

Scale your business without scaling your overhead. Switch factoring companies with ease.

Client Portal

Mirrors the subscriber portal, so factors can easily train their clients, reducing account executives’ workloads.

Secure and Agile

We’re SOC2 compliant and cloud-based. With access to 45+ software developers, our system is agile and configurable to adapt and innovate based on customer feedback.

OCR Automation

Our OCR software saves thousands of hours by automating the schedule creation process. It reads documents, scrapes data and automatically creates schedules in FactorCloud.

Open API

We have a rest API and can push and pull data, allowing seamless integrations with clients and third parties.

Switching To FactorCloud In Three Easy Steps

Changes can be hard. Our team is here to do the heavy lifting for you with our tried and true three step transition process:

We provide you with templates for the data export.

Our team works with you as you run FactorCloud in tandem with your current system.

We import your data and minimize noisy disruptions. You can close business in your current software tonight and open in FactorCloud tomorrow.

A robust set of features

Modernize your business with a cutting-edge solution.

configurable terms

schedule creation

Security matters

FactorCloud is proud to be certified SOC2 Compliant

Get in touch with us!

Get started using FactorCloud today. We will grow with your business, so you will never have to worry about outgrowing our invoice factoring solution.